Sc Sales Tax Certificate . Sales & use taxes must be filed and paid on retail sales (including online sales). This permit will provide you with a. The south carolina resale certificate requires a sales tax registration number, but doesn’t necessarily require you to. In order to have a south carolina resale certificate, you must first apply for a south carolina sales tax permit. You must have a retail license to make retail sales in south. Report the transaction to the sc department of revenue as a withdrawal from stock and pay the tax thereon based upon the reasonable and fair market value, but not less than the original. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Sales & use taxpayer s whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically.

from docslib.org

Sales & use taxpayer s whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically. In order to have a south carolina resale certificate, you must first apply for a south carolina sales tax permit. Sales & use taxes must be filed and paid on retail sales (including online sales). Report the transaction to the sc department of revenue as a withdrawal from stock and pay the tax thereon based upon the reasonable and fair market value, but not less than the original. The south carolina resale certificate requires a sales tax registration number, but doesn’t necessarily require you to. You must have a retail license to make retail sales in south. This permit will provide you with a. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

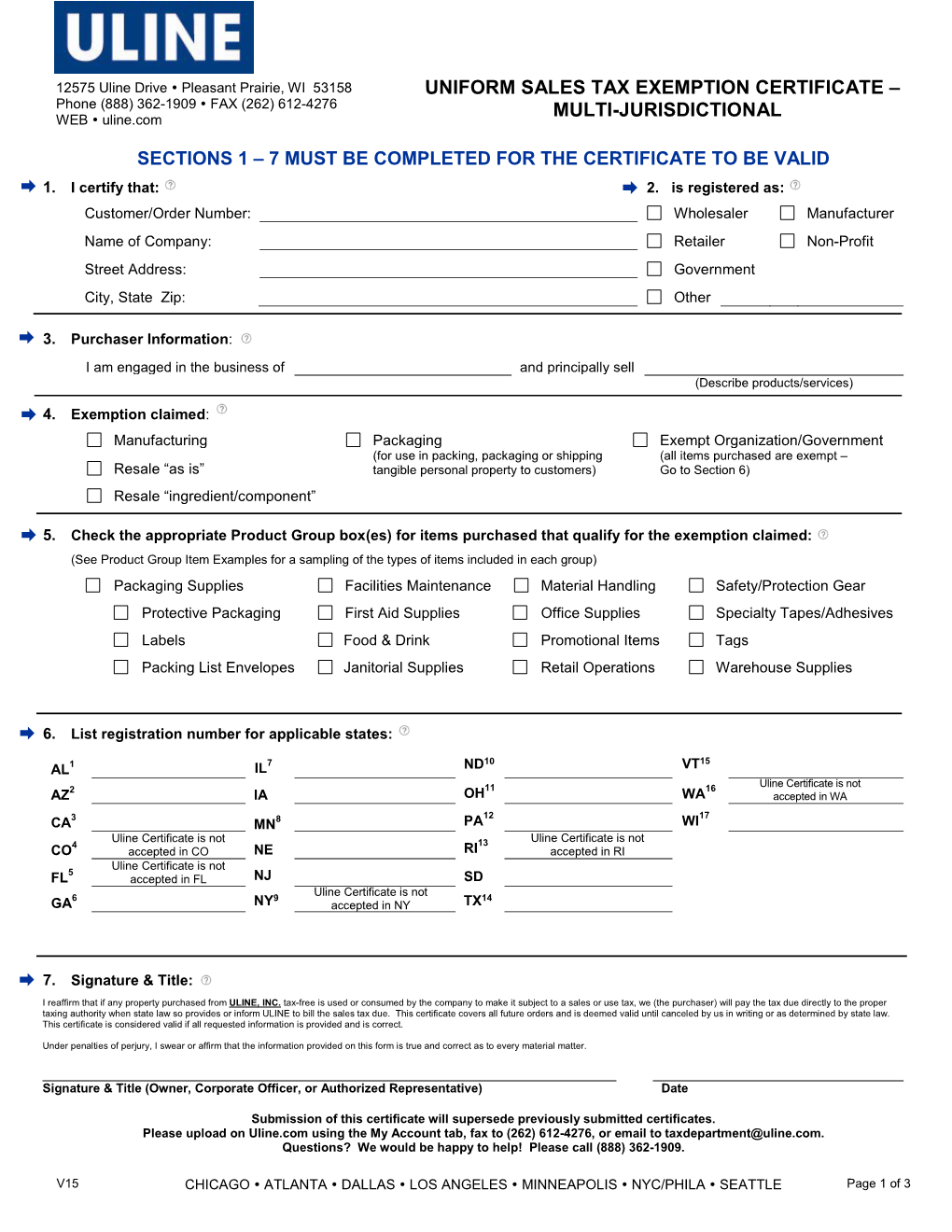

Uniform Sales Tax Exemption Certificate MultiJurisdictional DocsLib

Sc Sales Tax Certificate Sales & use taxes must be filed and paid on retail sales (including online sales). A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. The south carolina resale certificate requires a sales tax registration number, but doesn’t necessarily require you to. You must have a retail license to make retail sales in south. In order to have a south carolina resale certificate, you must first apply for a south carolina sales tax permit. Sales & use taxes must be filed and paid on retail sales (including online sales). This permit will provide you with a. Report the transaction to the sc department of revenue as a withdrawal from stock and pay the tax thereon based upon the reasonable and fair market value, but not less than the original. Sales & use taxpayer s whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically.

From pafpi.org

Certificate of TAX Exemption PAFPI Sc Sales Tax Certificate A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. The south carolina resale certificate requires a sales tax registration number, but doesn’t necessarily require you to. Sales & use taxpayer s whose south carolina tax liability is $15,000 or more per filing period must file. Sc Sales Tax Certificate.

From www.yumpu.com

Maryland Sales and Use Tax Exemption Certificates Sc Sales Tax Certificate Sales & use taxes must be filed and paid on retail sales (including online sales). A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Report the transaction to the sc department of revenue as a withdrawal from stock and pay the tax thereon based upon. Sc Sales Tax Certificate.

From www.slideshare.net

Sales Tax Certificate Sc Sales Tax Certificate The south carolina resale certificate requires a sales tax registration number, but doesn’t necessarily require you to. Sales & use taxes must be filed and paid on retail sales (including online sales). This permit will provide you with a. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are. Sc Sales Tax Certificate.

From www.hotzxgirl.com

Tax Compliance Certificate Checker Fill Online Printable Fillable Hot Sc Sales Tax Certificate Sales & use taxpayer s whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically. The south carolina resale certificate requires a sales tax registration number, but doesn’t necessarily require you to. Sales & use taxes must be filed and paid on retail sales (including online sales). You must have a retail license. Sc Sales Tax Certificate.

From procedures.tic.go.tz

1 Sc Sales Tax Certificate The south carolina resale certificate requires a sales tax registration number, but doesn’t necessarily require you to. Sales & use taxpayer s whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are. Sc Sales Tax Certificate.

From www.signnow.com

Sc Sales Tax Exemption 20162024 Form Fill Out and Sign Printable PDF Sc Sales Tax Certificate Sales & use taxpayer s whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Sales & use taxes must be filed and paid on retail sales (including online. Sc Sales Tax Certificate.

From docslib.org

Uniform Sales Tax Exemption Certificate MultiJurisdictional DocsLib Sc Sales Tax Certificate In order to have a south carolina resale certificate, you must first apply for a south carolina sales tax permit. You must have a retail license to make retail sales in south. The south carolina resale certificate requires a sales tax registration number, but doesn’t necessarily require you to. This permit will provide you with a. Sales & use taxes. Sc Sales Tax Certificate.

From www.vrogue.co

Resale Tax Form Certificates For All States Printable vrogue.co Sc Sales Tax Certificate Sales & use taxes must be filed and paid on retail sales (including online sales). A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. This permit will provide you with a. The south carolina resale certificate requires a sales tax registration number, but doesn’t necessarily. Sc Sales Tax Certificate.

From www.formsbank.com

Sales And Use Tax Resale Certificate Template State Of Maryland Sc Sales Tax Certificate This permit will provide you with a. Sales & use taxpayer s whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically. You must have a retail license to make retail sales in south. Sales & use taxes must be filed and paid on retail sales (including online sales). A sales tax exemption. Sc Sales Tax Certificate.

From www.signnow.com

Sc Certificate Request 20182024 Form Fill Out and Sign Printable PDF Sc Sales Tax Certificate Sales & use taxes must be filed and paid on retail sales (including online sales). This permit will provide you with a. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Sales & use taxpayer s whose south carolina tax liability is $15,000 or more. Sc Sales Tax Certificate.

From www.withholdingform.com

Colorado Withholding Tax Form Pdf Sc Sales Tax Certificate In order to have a south carolina resale certificate, you must first apply for a south carolina sales tax permit. Sales & use taxpayer s whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically. Sales & use taxes must be filed and paid on retail sales (including online sales). The south carolina. Sc Sales Tax Certificate.

From evausacollection.com

Bespoke Sales and use tax certificate.png Eva USA Sc Sales Tax Certificate The south carolina resale certificate requires a sales tax registration number, but doesn’t necessarily require you to. Report the transaction to the sc department of revenue as a withdrawal from stock and pay the tax thereon based upon the reasonable and fair market value, but not less than the original. Sales & use taxpayer s whose south carolina tax liability. Sc Sales Tax Certificate.

From www.pdffiller.com

2012 Form MN DoR ST3 Fill Online, Printable, Fillable, Blank pdfFiller Sc Sales Tax Certificate You must have a retail license to make retail sales in south. Report the transaction to the sc department of revenue as a withdrawal from stock and pay the tax thereon based upon the reasonable and fair market value, but not less than the original. In order to have a south carolina resale certificate, you must first apply for a. Sc Sales Tax Certificate.

From www.exemptform.com

Sales & Use Tax Exempt Form 2024 North Carolina Sc Sales Tax Certificate In order to have a south carolina resale certificate, you must first apply for a south carolina sales tax permit. You must have a retail license to make retail sales in south. This permit will provide you with a. Report the transaction to the sc department of revenue as a withdrawal from stock and pay the tax thereon based upon. Sc Sales Tax Certificate.

From www.pdf-archive.com

GMGU Sales Tax Certificate PDF Archive Sc Sales Tax Certificate A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Report the transaction to the sc department of revenue as a withdrawal from stock and pay the tax thereon based upon the reasonable and fair market value, but not less than the original. This permit will. Sc Sales Tax Certificate.

From www.vrogue.co

Resale Tax Form Certificates For All States Printable vrogue.co Sc Sales Tax Certificate Sales & use taxpayer s whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically. Sales & use taxes must be filed and paid on retail sales (including online sales). A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from. Sc Sales Tax Certificate.

From www.tayvalleytwp.ca

Tax Certificates Tay Valley Township Sc Sales Tax Certificate Sales & use taxpayer s whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically. Sales & use taxes must be filed and paid on retail sales (including online sales). You must have a retail license to make retail sales in south. This permit will provide you with a. In order to have. Sc Sales Tax Certificate.

From mavink.com

Sales Tax Exemption Certificate Sc Sales Tax Certificate You must have a retail license to make retail sales in south. Report the transaction to the sc department of revenue as a withdrawal from stock and pay the tax thereon based upon the reasonable and fair market value, but not less than the original. A sales tax exemption certificate can be used by businesses (or in some cases, individuals). Sc Sales Tax Certificate.